The transport sector is the third largest source of GHG emissions in China, following the power and industry sectors. Heavy-duty truck transportation accounts for 41% of the country’s freight demand (in tonne-kilometers) and 84% and 40% of motor vehicles’ NOx and CO2 emissions, respectively. Driven by growing levels of goods movement, the emissions from heavy-duty trucks in China will continue rising if nothing changes.

Although multiple decarbonization interventions exist, the recent technology advances in electric vehicles offer perhaps the most promising opportunities for the sector’s decarbonization. Based on widespread stakeholder engagement, WRI China has found that four areas are critical to promote electric heavy-duty vehicle technologies and infrastructure deployment in China.

1. China Needs a Technology Roadmap for Zero-Emission Trucks

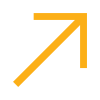

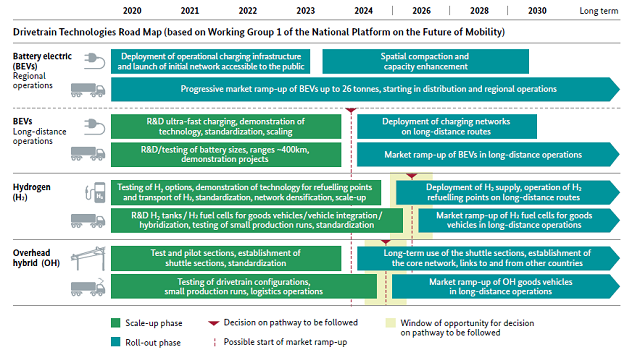

A China-specific technology roadmap is integral to standardize vehicles’ technical requirements and invest in compatible charging and refueling infrastructure. The roadmap is particularly important for the heavy-duty truck sector. Unlike buses and passenger cars, viable decarbonization technology solutions for heavy-duty trucks are not ready for large-scale rollout. Various powertrain technologies backed by different manufacturers are competing for market share and are still in nascent stages, such as battery electric trucks, overhead catenary electric trucks, battery-swapping electric trucks, hydrogen fuel cell trucks, and even electricity-based fuels.

Furthermore, there would likely be no single solution to replacing diesel trucks in the future. Under different use cases, from intra-city freight to regional and long-haul transport, the requirements on gross vehicle weights and haulage distances differ, thereby requiring different powertrains. Even within a specific use case, there are often multiple solutions.

To align vehicle technical specifications, infrastructure deployment and regulations, Germany has set an example by developing guidance for an “Overall Approach to Climate-friendly Commercial Vehicles.” The aim is to power at least one third of the mileage of heavy-duty truck haulage by electric or electric fuel-powered vehicles. However, such a technology roadmap is not universally applicable. For example, in Germany, “e-highways,” with overhead electric lines, have gained traction, while in China, momentum is instead gathering around battery swapping.

2. Battery Swapping Gaining Momentum

Contrary to mainstream plug-in battery electric trucks, battery swapping trucks are gaining momentum in China. These trucks are designed for batteries to be quickly removed and replaced, allowing drivers to replace depleted batteries with recharged ones on a regular basis. Over a dozen Chinese manufacturers have released more than 80 battery swapping vehicle models of drayage trucks, dump trucks, straight trucks and specialized vehicles that are used in regional transport, seaports or mining sites.

The popularity of battery swapping in China can be attributed to the short charging time. For example, in Shenzhen, a plug-in dump truck with a 430kWh capacity may require a few hours of charging, whereas battery swapping dump trucks only need few minutes to get a full charge. Smaller battery capacities (141kWh or 282kWh) and lighter gross weights of vehicles also avoid payload losses.

Battery swapping is becoming commercially viable in China. By separating the ownership of batteries from vehicles, operators of battery swapping stations own batteries and lease them to vehicle owners. In addition to battery swapping service fees, operators of battery swapping stations can gain additional revenues from leveraging reserve batteries or second-life batteries to provide grid services like energy arbitrage (storing energy during off-peak hours to discharge during peak hours).

However, the road to increased adoption of battery swapping trucks in China also has barriers, including lack of uniform standards for battery design, and increased charging service fees that make battery swapping less economical. Therefore, whether battery swapping will dominate China’s intra-city and regional market still depends on manufacturers’ and governments’ determination to overcome these barriers.

3. Progress Needed on Ultra-Fast-Charging Technologies

Fast-charging technologies are the key to unlocking the potential of electrification of long-haul trucks in particular. Fast charging reduces not only charging durations, but also truck drivers’ working hours. Although ultra-fast charging and overhead catenary charging are candidates for fast-charging technologies, their widespread adoption won’t occur for another few years when technologies are ready, vehicle/infrastructure standards are developed, infrastructure are provided, and manufacturers and governments are on board.

To enable “ultra-fast charging,” which supports a charging power over 350kW, updated standards and rapid technology advances are needed. The Combined Charging System standard adopted by the U.S. and European countries already supports ultra-fast charging, and major European highways are equipped with an ultra-fast charging network, where a heavy-duty truck with a 500km range currently requires over 1.5 hours of charging. An updated version of the standard supporting a charging power up to 1 MW – the Megawatt Charging Standard – is under development that would allow a 500km-range truck to need only about a half hour of charging.

In China, the existing national charging standard only enables charging power up to 237.5kW. To further increase charging power and reduce charging durations, China is working with Japan’s CHAdeMO association to develop a standard that will support up to 900kW charging. However, industry concerns must be addressed, including increased vehicle prices due to new technologies to support higher charging powers and incompatible charging outlet design between the new standard and the old national standard.

4. E-Highways Still a Nascent Area

For overhead catenary, “e-highway” charging, in which trucks connect to overhead power lines while driving, the appeal of this method is that no stops for charging are needed and even with the infrastructure investments required, the total cost of ownership of e-highway trucks is lower than that of battery electric trucks.

Germany has successfully piloted e-highways in three sections of the country’s highway system. However, the migration of this technology to China requires substantial governmental and industry support.

First, as public infrastructure, e-highways require government endorsement. The German government is considering using CO2-based road tolls to fund the infrastructure, but such funding mechanisms are absent in China. Furthermore, disinterested manufacturers are another roadblock, likely due to limited awareness of the technology, lack of in-house technology development, or a combination of other reasons. The prospect of e-highways in China is still unclear.

Achieving Infrastructure Synergy

With a variety of zero-emission truck technologies in development, synergy among various infrastructure deployment is essential to increase charging facility availability and avoid repetitive investments. For example, one recent study out of Germany suggests that jointly developing different charging infrastructure at the same time can be useful: ultra-fast chargers can serve low-utilized highway corridors for trucks, while overhead catenary charging can serve main trucking corridors, with trucks able to charge in both ways. A similar approach could be adopted in China with possible synergies created between fast charging and battery swapping.

Emissions from heavy-duty trucks in China remain significant yet hard to abate due to heavy payloads, long distances and nascent technologies. Substantial efforts, from technological advances to coordinated policies, are essential to decarbonize the sector to meet the world’s 1.5-degree goal. WRI China is helping to advance China’s zero-emission transition through national charging standard amendments, infrastructure planning and vehicle-grid integration. WRI is also working closely with the ZEFV ACTion Group to facilitate a mass market for zero emission freight vehicles.

Lulu Xue is Urban Mobility Manager at WRI China Ross Center for Sustainable Cities.